Identity Review | Global Tech Think Tank

Keep up with the digital identity landscape.

Update: 6/18/22 At present, the balance sheets of many crypto lenders do not have enough liquid assets to cover withdrawals – this may be a “Lehman Brothers” moment for crypto. For tips, please email team@identityreview.com.

It’s 2021 and there’s a hot new way to make money: lend your funds to crypto lenders.

The idea is simple: You deposit your currency, say Bitcoin, into a lender who lends out your money into the market for a high interest rate. While it sounds like an amazing opportunity to earn more return on investment, there are some serious risks.

Crypto lending is handled in an unregulated market with little oversight.

Yet, there are no guarantees, protections, or recourse for depositors in the event of a default. In many cases, there is no insurance and no central authority to resolve disputes between lenders and borrowers. Lenders today are struggling to collect from unsecured counterparties, and the default rates are skyrocketing.

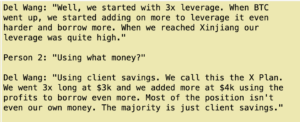

Leaked recordings revealed that the CEO of one lending company, Babel, was engaging in highly risky leverage bets using clients’ Bitcoin savings. There was no backup plan if BTC fell too low.

Example of the risky behavior behind one lender. Source

While some decentralized platforms offer automated systems to liquidate collateral in an attempt to keep depositors safe, many lenders have nothing stopping them from investing your money into high risk assets with no guarantees of paying it back. In fact, if something goes wrong with the transaction (say, the lender gets hacked, makes a risky bet, or lends money to an counterparty that becomes insolvent), there is no recourse to sort through it other than bankruptcy.

It’s important to note here that this isn’t just about crypto lending—it applies equally well for traditional forms of depositing money too (like when you deposit money into any financial platform such as a bank, or apps such as Venmo or PayPal). However…

Depositors viewed these lenders as safe “savings” accounts with high rates of interest. They are not.

The crypto lending business model is predicated on the idea that depositors will be attracted to the high interest rates, security and limited risk of default offered by crypto assets.

Crypto lenders do not hold deposits in a special fund earmarked for creditors; instead they hold them in their own accounts and use them to trade or borrow against. This allows them to increase liquidity but it has also brought about a number of problems including large losses when funds are lost due to hacks and other cyber-security breaches; lack of transparency around how much collateral is being used; concentration risk if just one borrower defaults; etc.,

Lenders are continuing to have to invest more and more capital into the market as liquidity dries up.

As crypto lending continues to grow, lenders are continuing to have to invest more and more capital into the market as liquidity dries up.

The reality is that balance sheets do not have enough assets to cover withdrawals – this is the Lehman Brothers moment for crypto. Liquidity is drying up faster than lenders can keep up with.

This is a problem, because it means that lenders are having to lend at higher rates to maintain liquidity. This drives up the cost of capital for borrowers, who can no longer get loans from crypto lenders because they’re too expensive.

The increased cost of borrowing capital is going to hurt the crypto industry in two ways: firstly, it will cause it to shrink; secondly, and more importantly, it will make lending less profitable which puts consumer funds at risk.

As demand for loans goes down and supply stays constant or grows, lenders are forced into a situation where they have to invest more and more capital into their business just so they can stay solvent. In capital flush markets, this may not be an issue. But with the recent rate hikes, capital may be hard to come by.

While many of these companies have pledged their assets as collateral for borrowing. If those assets continue to drop in value, then the lenders will be forced to liquidate their positions at fire sale prices. This can cause a chain reaction and cause all crypto assets—including Bitcoin—to go into freefall.

In the event of a default, lenders have no recourse or insurance against their losses. If a lender’s cryptocurrency is stolen or lost, they will not be able to recover their funds through any government agency or other entity because these projects are not regulated and insured by any government entity.

Additionally, these projects often do not undergo audits by outside parties nor make their financial information public for outsiders to verify; so there is no way for investors to know how much money has been lent and whether the borrower can repay it. Finally, some crypto lenders and counterparties operate essentially anonymously and don’t provide any transparency into how they operate as business entities—making it impossible for anyone outside of those companies themselves (and sometimes even within them) to determine whether they are solvent enough in order for users’ money being held at those entities remain safe from being stolen over time without notice given beforehand until after something bad happens which could lead up costing users lots of money depending on how much has already been lent out per person before then which means that this entire industry should never get off ground in first place but instead should be shut down completely.

It’s time for transparency and mature risk management practices. In reaction to market volatility, companies like Nexo have started to publish audits. We’re hosting a working group to discuss risk management for crypto funds and treasuries.

The crypto lending sector is a highly risky one, even more than most consumers might realize. There are many factors that both depositors and lenders need to be aware of before putting their money into these exchanges. The fact that there is no regulation over these markets means that the risks are both very high and very hard to assess. In addition, the fact that there is no government insurance protecting these deposits leaves depositors with virtually no recourse in the event of lender insolvency or fraud. Furthermore, lending practices as a whole are also highly risky due to their reliance on interest rates that fluctuate from day to day or even hour by hour.

By understanding all of these factors, borrowers can make informed decisions about whether or not they want to take on risk when borrowing money through this method.

Do you have information to share with Identity Review? Email us at press@identityreview.com. Find us on Twitter.

RELATED STORIES