Identity Review | Global Tech Think Tank

Keep up with the digital identity landscape.

Within today’s data-centric world, the largest sector for decentralized applications (dapps) has been lending and borrowing crypto assets. Decentralized lending platforms allow anyone, anywhere, to share and borrow with the requisite of an Ethereum wallet. These DeFi lending platforms serve as the newest financial service enabler, all while implementing the security and trustless benefits that blockchain and cryptocurrency provide.

DeFi lending allows investors and lenders to issue loans or deposit fiat for interest through a distributed and decentralized application system. This is a captivating option through the eyes of lenders because it allows them to earn a relatively low-risk interest on existing holdings without having to authorize their information to 3rd party services.

In the past few years, the marketplace has seen even more valuable and innovative decentralized lending platforms. The ability to lend and borrow assets among completely open applications has created a fundamental breakthrough for the future of finance and cryptocurrency.

Need a second opinion? Download our Top Crypto Lawyers Report here.

Here are some of the topmost decentralized lending platforms you should know about.

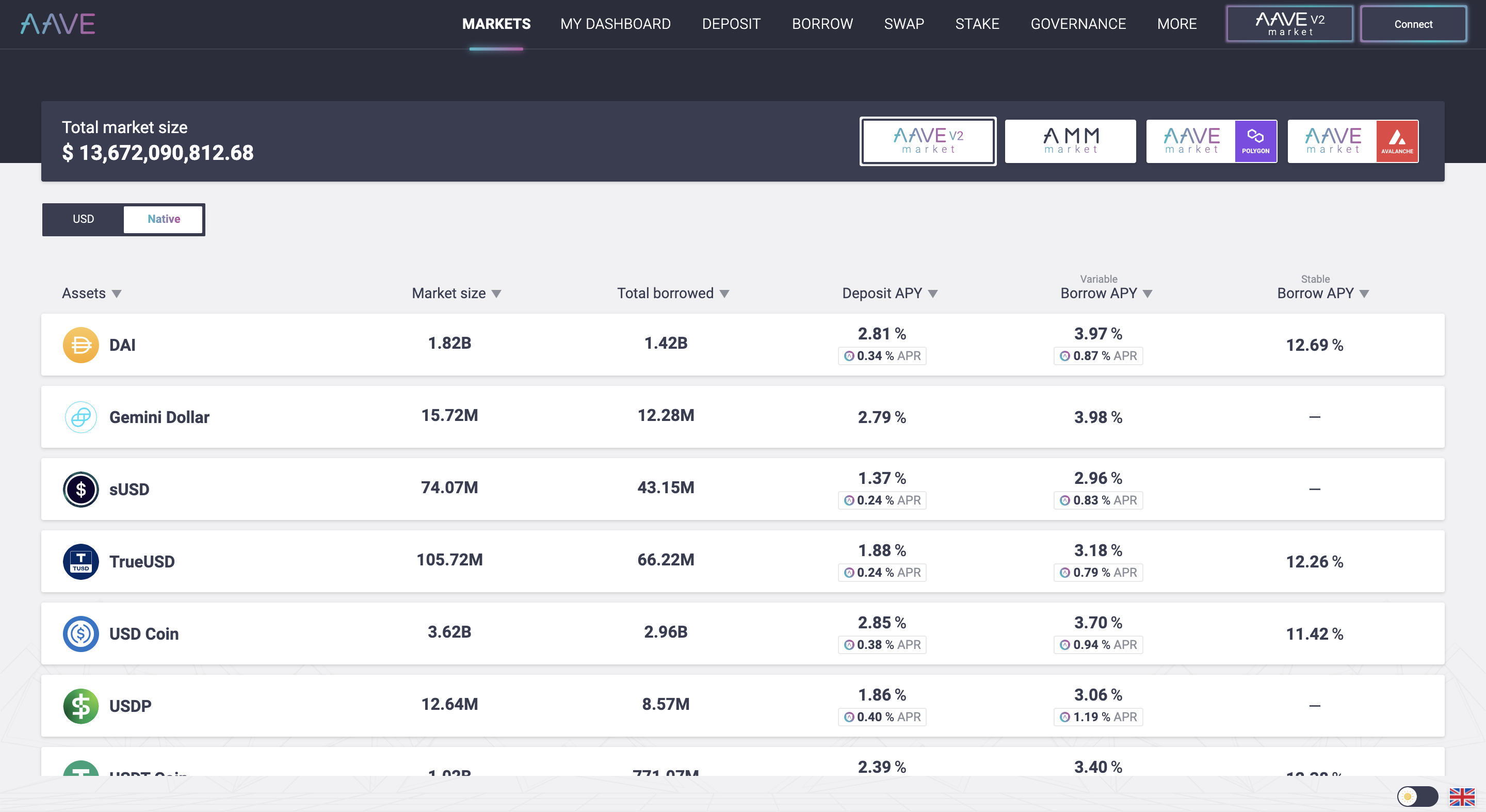

1. Aave

Aave is a decentralized non-custodial liquidity market platform in which users can participate as depositors or borrowers. According to the Aave website, “Depositors provide liquidity to the market to earn a passive income, while borrowers can borrow in an over collateralized (perpetually) or undercollateralized (one-block liquidity) fashion”.

If users are looking to use the Aave protocol, users first deposit the chosen asset and amount. Shortly after, the lender will earn passive income based on the market borrowing demand. Additionally, depositing assets allows consumers the ability to borrow by using the deposited assets as collateral. The interest you earn by depositing funds may help offset the interest rate users accumulate by borrowing.

2. MakerDAO

MakerDAO is a widely used decentralized governance platform enabled by DAI, a cryptocurrency with the target price being $1, also known as a stablecoin. The decentralized governance community of MakerDAO manages the generation of DAI through an embedded governance mechanism within the Maker Protocol.

The Maker Protocol is a set of smart contracts designed to reduce the price volatility of DAI stablecoin, allowing lenders and borrowers to borrow different digital currencies without counterparty risk. The Protocol was the first decentralized finance (DeFi) application to earn significant adoption and remains one of the largest decentralized applications (DAPPs) on the Ethereum blockchain.

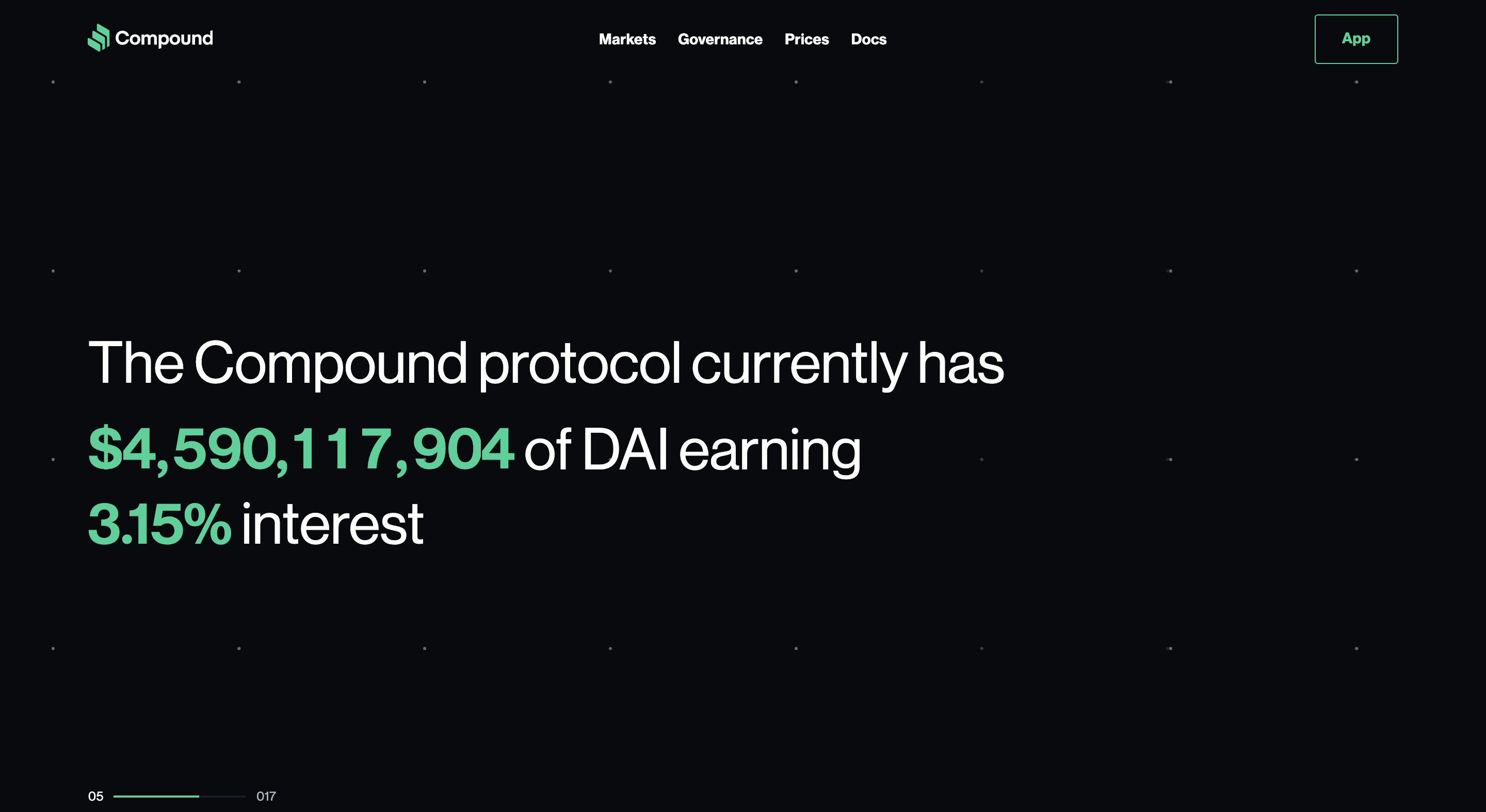

3. Compound

Compound is a DeFi-based lending application within the world of cryptocurrency that uses a money market approach, which uses different pools of capital for each supported asset. Lenders can deposit given amounts into lending pools, continuously earning interest with no fixed loan durations.

Compound recently introduced a governance system to replace their past protocol administrator with governance from the community, allowing users to suggest, debate, and implement developments or advice.

4. PhoenixDAO

PhoenixDAO, a community-based decentralized platform, uses custom-made solutions to cater to the needs of businesses and institutions while influencing the next generation of DeFi applications. The platform aims to achieve full decentralization through governance and control from an invested network of community members. The DAO will be powered by Phoenix’s Identity-powered dapp store, ensuring a one-person-one-vote system.

The decentralized application dapp, allows users to earn immediate interest on staked PHNX tokens at up to 20% APY. There is currently a team at PhoenixDAO implementing advanced features to an upcoming version, such as liquidity farming and the ability to participate on the DAO platform through the native PHNX token.

5. Alchemix

Alchemix is a DeFi loan-based platform that uses a new method to provide loans that “pay themselves back over time.” Users deposit DAI into a smart contract. In exchange, users receive a token that represents the deposit’s future yield farming potential. The token used through Alchemix is known as alUSD, which can be transmuted for DAI within the Alchemix platform and traded on a given DeFi exchange.

According to the company website, the platform “lets you reimagine the potential of DeFi by providing highly flexible instant loans that repay themselves over time. The synthetic protocol token (alUSD) is backed by future yield.”

6. Venus

Venus is a decentralized marketplace created for lenders and borrowers with borderless stablecoins. The platform website states that it “enables the world’s first decentralized stablecoin, VAI, built on Binance Smart Chain that is backed by a basket of stablecoins and crypto assets without centralized control.”

Their protocol sets interest rates in a curve yield, where rates are automated based on the demand of a specific market.

“The difference of Venus from other money market protocols is the ability to use the collateral supplied to the market not only to borrow other assets but also to mint synthetic stablecoins with over-collateralized positions that protect the protocol.”

Do you have information to share with Identity Review? Email us at press@identityreview.com. Find us on Twitter.

RELATED STORIES