Identity Review | Global Tech Think Tank

Keep up with the digital identity landscape.

From 2018 to 2019, new account fraud was up 13%, and financial institutions are feeling the pressure to find innovative ways to beat the issue. With new account fraud accounting for over $3 billion in losses each year, billions are spent annually on these losses, and the pace is increasing. Fraudsters are driving Account Opening Fraud through the use of stolen or synthetic identities to open new accounts, maxing out credit lines and withdrawing cash. The financial losses only account for part of the damages. In the U.S., cardholders spend an average of 15 hours to resolve new account fraud.

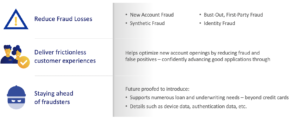

Visa is tackling the issue head on. Visa recently announced Advanced Identity Score, a digital tool to help U.S. financial institutions with their efforts to combat new account fraud.

The Fair Credit Reporting Act (FCRA)-compliant identity fraud score combines Visa’s artificial intelligence and predictive machine learning capabilities with application and identity related data to generate a risk score for new account applications. This serves to reduce fraud, prevent negative impact to brand loyalty and trust, and eliminate operational costs due to remediation.

Advanced Identity Score aims to decrease the number of new accounts opened with stolen identities and protect consumers against account takeover fraud.

“Visa’s mission to connect the world and enable individuals, businesses, and economies to thrive is more important than ever with COVID-19 affecting communities and all parts of the economy,” said Melissa McSherry, Senior Vice President and Global Head of Data, Security and Identity Products and Solutions at Visa. “As consumers, financial institutions and merchants focus on controlling expenses during uncertain times, the cost of new account fraud in terms of money and time lost can be significant. Advanced Identity Score offers financial institutions a powerful tool to use on top of existing systems and processes to prevent identity related fraud.”

Most financial institutions employ a layered fraud prevention strategy using multiple tools to combat identity related fraud, but many legacy fraud prevention systems are rules-based with gaps and limitations that may create customer friction or false positives.

Advanced Identity Score helps financial institutions make more informed risk decisions through it’s two-digit identity fraud score which aims to prevent fraud loss at the point of credit or loan application. It is the only fraud solution harnessing virtually all U.S. approved or declined bank card application data and account level fraud data.

“With more than 14.7 billion data records breached since 2013, many of which include sensitive data such as name, tax ID number, and address, new account fraud has been a consistently growing challenge for financial institutions,” said Julie Conroy, research director, Aite Group. “Financial institutions are looking for solutions that can help effectively detect synthetic and stolen identities at the time of application. The consortium data and sophisticated analytics that power Visa’s Advanced Identity Score promise to make it a valuable addition to financial institutions’ control framework.”

According to Mylissa Barrett, Vice President of Identity and Risk Products at Visa, the team behind the new tool was focused on not only how they could mitigate the identity-related crime, but also creating a brand agnostic solution that both financial institutions and non-banking financial companies can utilize to create operational efficiencies. Some of these benefits include a more effective false-positive rate and allowing companies to implement manual verification.

“Our focus was to try and figure out how we get a large enough training data set to identify instances of fraudulent and good applications. Then determine what those attributes are and how they interact so that we could predict application fraud over a period of time,” said Barrett. “Based on some of the other products that we deliver in the marketplace around our own machine learning and models that we provide related to fraud transactions, we wanted to bring something actionable, that issuers could certainly rely on, but also be effective in helping to improve risk-splitting.”

Visa has been developing their artificial intelligence capabilities for nearly 25 years. Since then, the company has been continuously evolving and investing in the technology, with Advanced Identity Score being Visa’s latest creation.

Visa’s artificial intelligence examines data points in areas including application velocity (the frequency of applications within a period of time), fraud and suspicious activity, bankruptcy data across consumer identity elements, all while incorporating data from government agencies, 3rd party data providers, law enforcement agencies, and self-reported data from consumers. This combination empowers financial institutions with a tool for risk management that can adapt as criminal behavior changes.

“Fraud, especially when you’re talking about synthetic identity, first-party fraud, third party fraud, account takeover, can be really complicated in terms of identifying those things. So I think the model itself is just focused on making sure that we capture the complex interactions of those types of things,” stated Barrett. “In this particular case we have been very focused on improving the false-positive rate and the competence of financial institutions. So being able to deliver that type of detection is paramount for us.”

Advanced Identity Score will be available to Visa’s network of connected national institutions, but Barrett also sees opportunities in it being extended across other lines and loans of businesses, fintechs and non-banking financial companies. Visa is focused on offering the solution in the United States, but will evaluate opportunities to expand around the world.