Identity Review | Global Tech Think Tank

Keep up with the digital identity landscape.

Our personal data is everywhere and it is not secure. 50% of people use the same password for all their accounts. With an increasing number of users online and sharing their data across different accounts, the internet has become an incredibly fertile ground for hackers.

In 2020 alone, 37 billion records were exposed to hackers, an incredible 48% increase over 2019.

Even putting aside data breaches, the legal uses of customer data can often stretch ethical bounds. While the European Union has been stringently enforcing GDPR and California recently implementing the CCPA, the regulation of data privacy still runs far behind technological innovation.

Nuggets, a UK-based payments ID platform that stores personal data with blockchain technology, is attempting to upend this paradigm by giving users control over their data.

The idea for Nuggets originated when Alastair Johnson, now founder and CEO of the startup, was the victim of a data breach and had to cancel his credit card.

“I had the painful task of contacting the various companies which had my credit card on file and updating them with my new card number,” Johnson told PaymentsSource in a 2018 interview. “I thought there had to be a better way than this.”

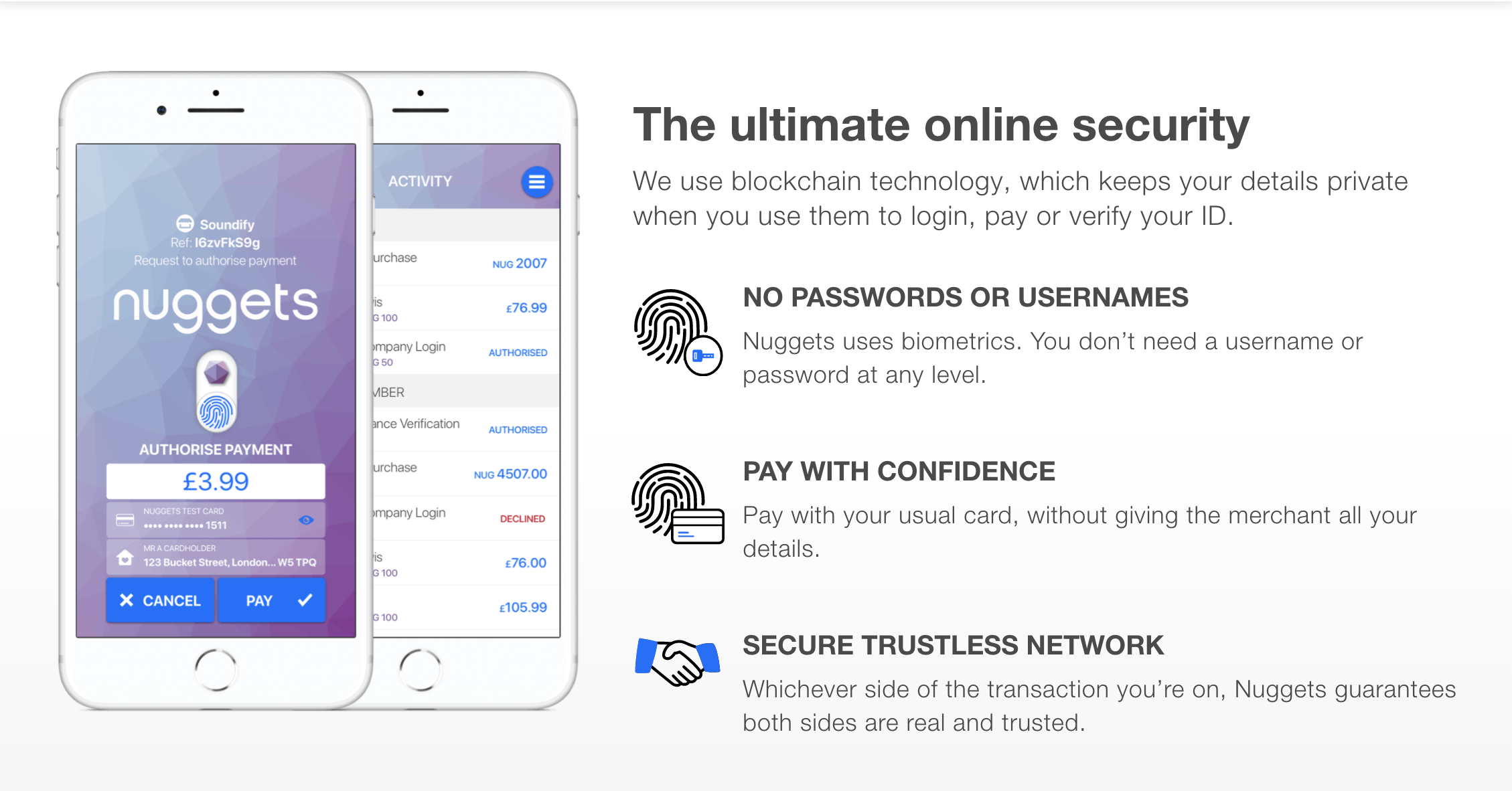

Nuggets is an ambitious project, but its core product is straightforward. By combining biometric information with blockchain technology, Nuggets aims to build a platform where users can login, pay for goods, and verify their identities without sharing their personal data with anyone. The power of blockchain technology means that no one can access the data shared on Nuggets, including the startup itself.

Source: Nuggets.life

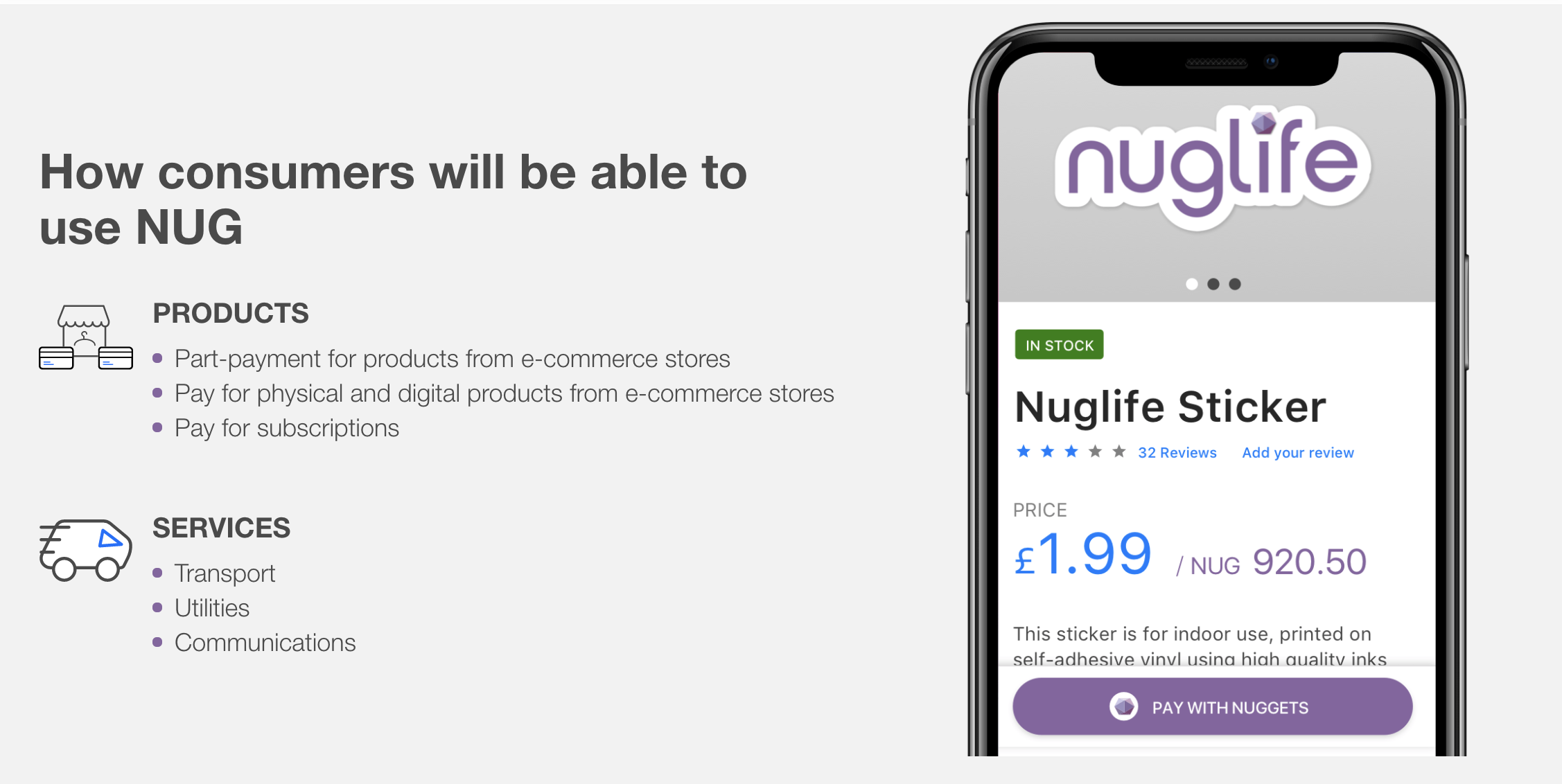

Nuggets also offers Nuggets Tokens, which users can use to pay for goods offered by companies on the platforms. The more Nuggets Tokens you use, the more you earn. Users can also gain tokens by offering to share their personal information with a merchant. This structure means that users not only control which data they share with merchants, but they are also compensated for doing so. If you are the product, you should be the one paid. Nuggets calls this new ecosystem the “Internet of value.”

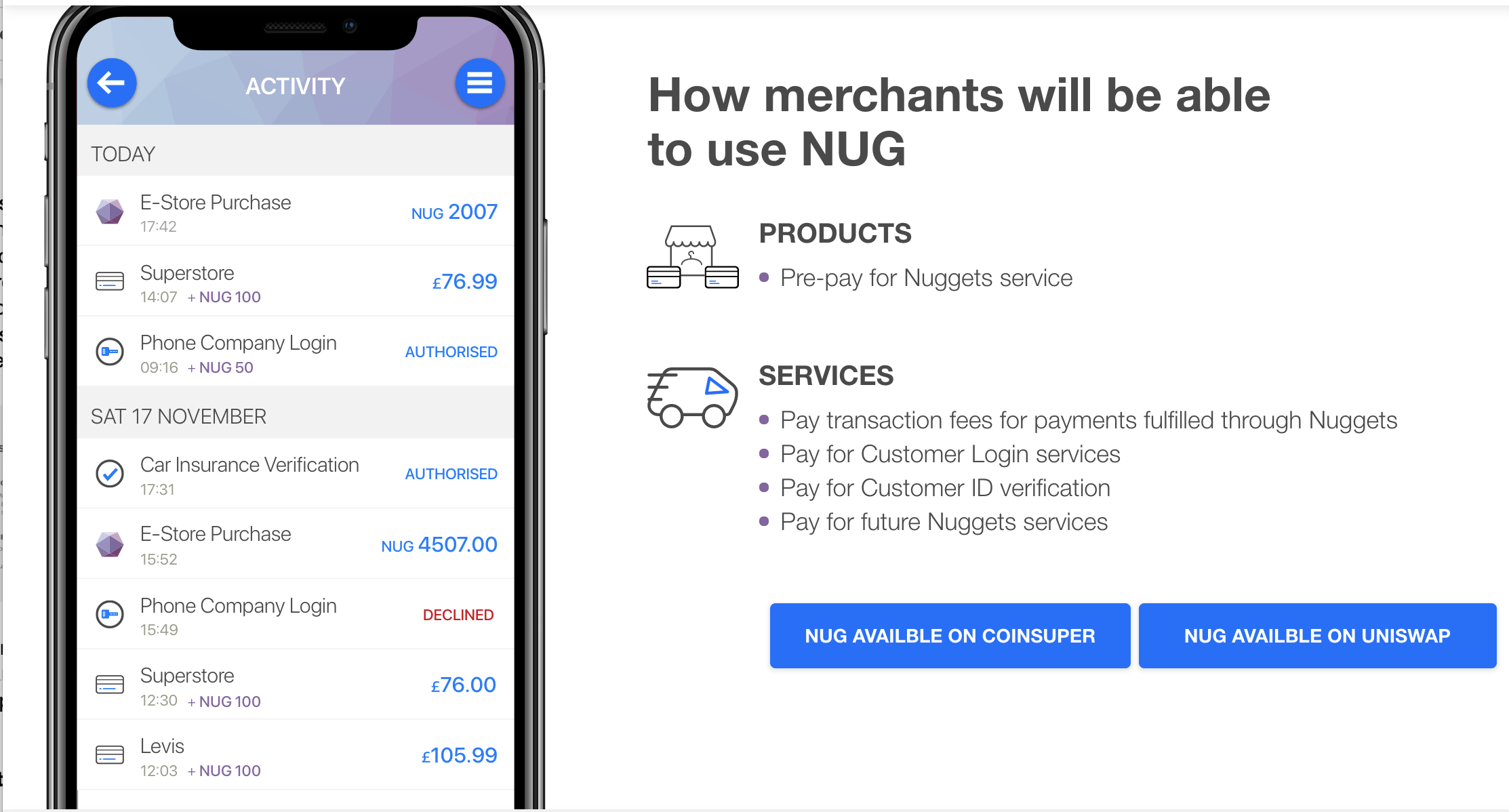

On the merchant side, a video on the company site explains that Nuggets Tokens can help merchants avoid fraud, false positives, data breaches or chargebacks. While there are not many specifics offered, it is likely that the reduction in fraud occurs due to use of the blockchain.

Source: Nuggets.life

Nuggets has been gaining momentum recently. COO Seema Khinda Johnson, a former Microsoft and Skype Executive like Johnson, won the Deutsche Bank-sponsored 2020 Female Fintech competition. The startup was also named mobile innovation of the year by Retail Systems in 2020 and as one of the 10 best global payments startups by Elfma Capgemini.

Now, Nuggets is looking to grow its offerings as part of the Accenture Fintech accelerator. The accelerator had just an 8% acceptance rate and is expected to run until March 31st, 2021.

Seema Khinda Johnson commented on Nuggets’ participation in the accelerator in an interview with Biometric Update: “This comes at a great time for Nuggets as we start to scale the business. Being accepted into the programme is a tremendous opportunity that will enable us to showcase our technology to every bank and financial institution who are all looking for a fast, safe path to innovation, especially when it comes to privacy.”

Nuggets’s ultimate goal, according to their website, is to build an “Internet of value,” where users control their data and sellers do not have to worry about fraud. Nuggets’ ambitious undertaking has already caught the attention of many important players in the industry, and we will monitor their progress on this front in the years to come.

ABOUT THE WRITER

Quinn Barry is a Tech Innovation Fellow from Stanford University covering innovations in digital privacy across finance and government.

Contact Quinn Barry at quinn@identityreview.com.

Do you have information to share with Identity Review? Email us at press@identityreview.com.