Identity Review | Global Tech Think Tank

Keep up with the digital identity landscape.

The global digital identity market is expected to grow from $13.7 billion in 2019 to $30.5 billion by 2024, with Asia Pacific growing the fastest of any region. The software-as-a-service market in Asia, moreover, is projected to reach $58.4 billion by 2025.

Credify, a Singaporean digital identity startup, aims to tackle the growing need for secure digital identity solutions in the enterprise in Asia. The startup recently closed a $740,000 seed extension led by Japanese IT company TIS and hopes that the next partnership will help Credify expand into Japan.

Makota Tominaga, CEO of Credify, is optimistic that his company is early to the digitization of Asian businesses: “Large enterprises across Asia are just now facing the challenges of their digital transformation journeys,” said Tominaga.

The recent fundraise follows a $1 million round funded by Beenext and Deepcore in February, both of which participated in the most recent fundraising round. While terms were not disclosed, Credify did disclose that the new funding increased their valuation by nearly 60%.

Credify works with financial and e-commerce firms to verify consumer identities and prevent fraud. With Credify, the user controls their data and is empowered to share it with institutions in order to gain access to products. Credify has four main product lines, each of which serve its core mission of improving trust in online transactions between consumers and businesses.

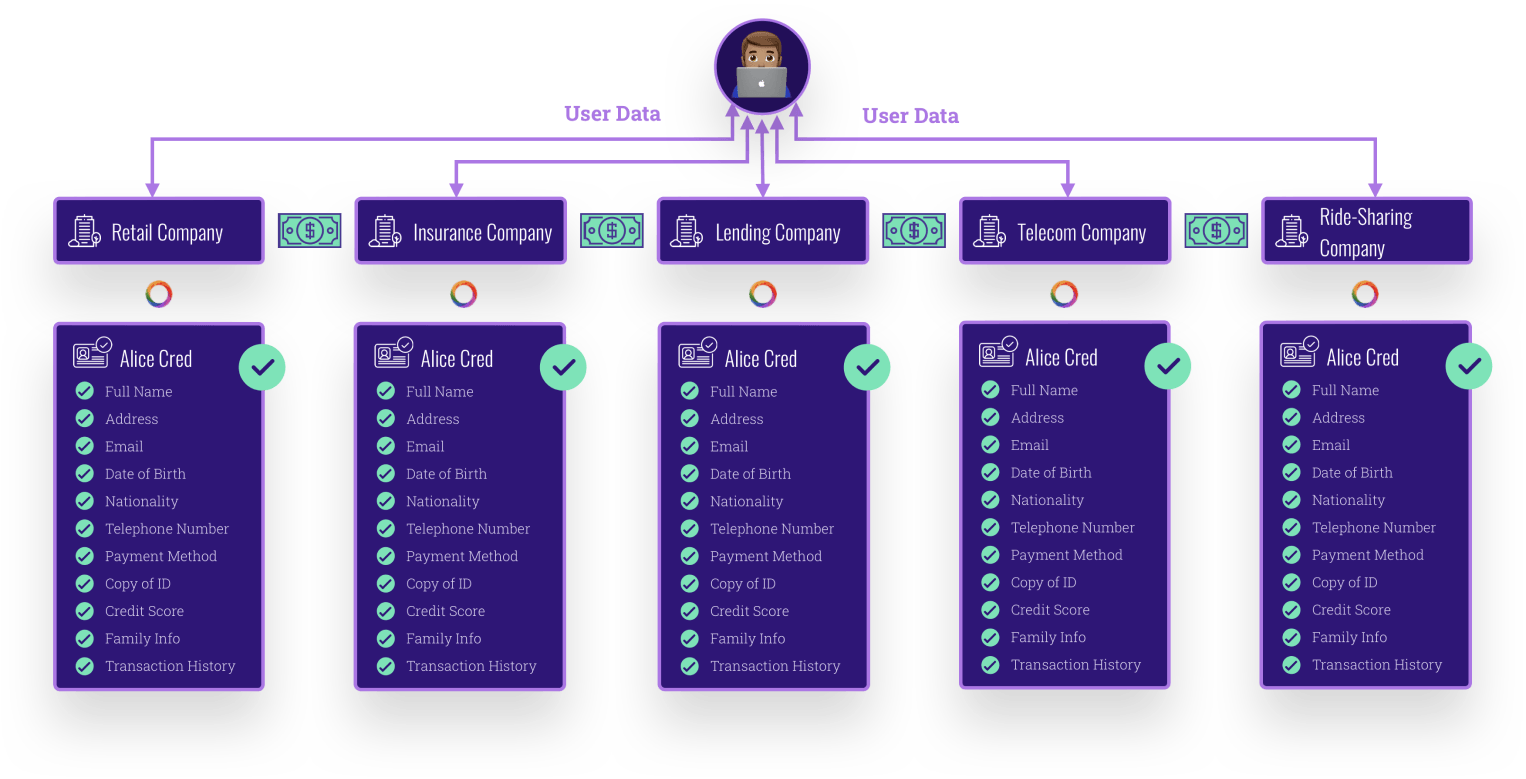

Credify’s idX, also known as its Identity Exchange, allows users to share their digital identities securely across different verticals, including retail, insurance, lending and ridesharing. idX functions as a digital identity passport; users control where their own personal information is shared, and can use their information to gain access to a variety of services. Digital identities included in idX consist of credit scores, verified identities and other contextual data about users.

How idX works from the user’s perspective

idPass is described on Credify’s website as “a fully customizable SuperApp platform built on idX technology that supercharges your digital transformation.” While there is no detailed information about the product, it appears to be the central hub where users manage their online transaction spend and digital identities.

A picture of a smartphone running idPass

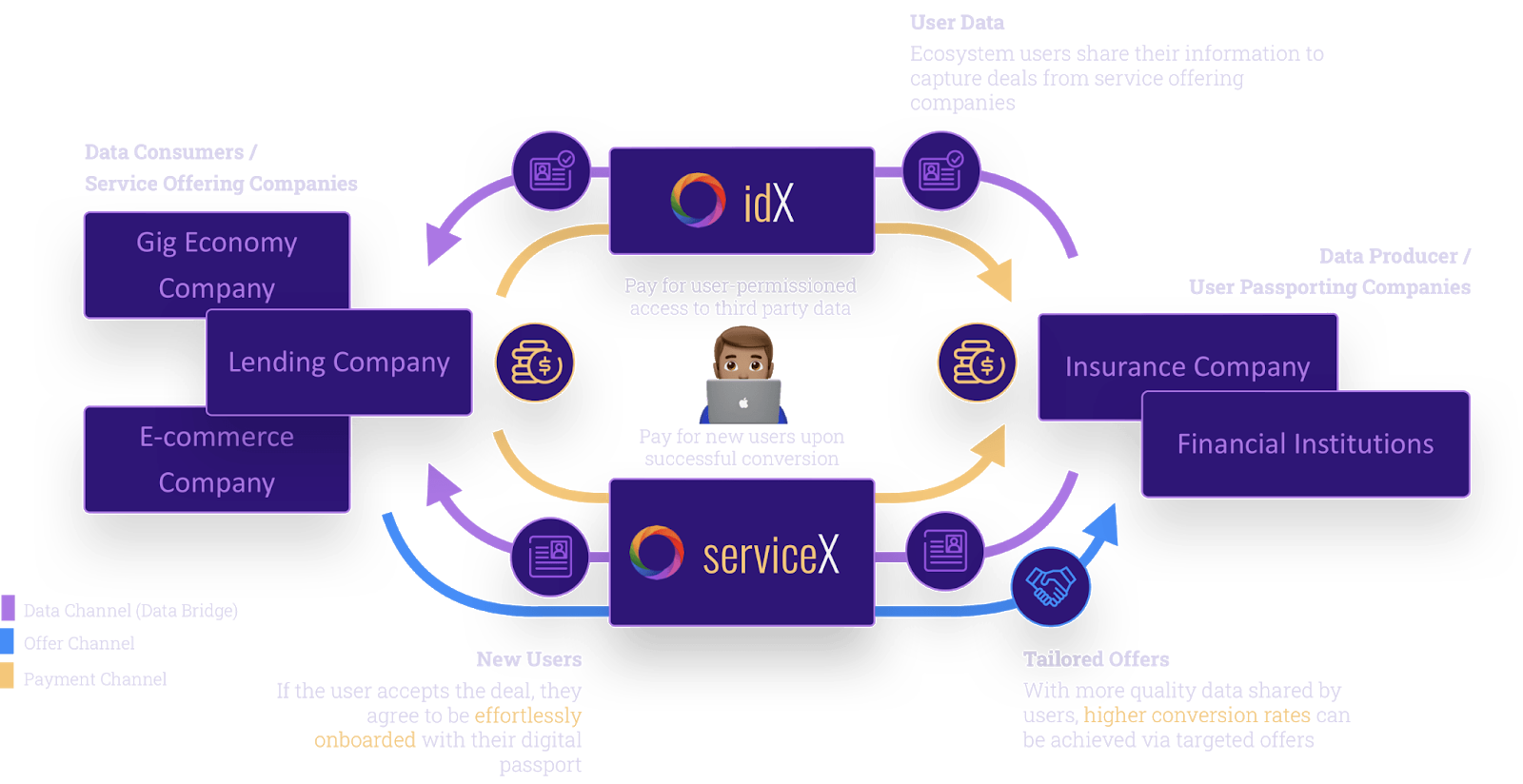

ServiceX, also known as Service Exchange, leverages the idX exchange to connect e-commerce firms to buyers interested in their products, based on the data in their digital profiles. There are two key distinctions between ServiceX and the traditional ad targeting model:

Given the detailed profile that Credify forms on its users, Credify hopes that ServiceX “ultimately[s] grow more effective than AdWords or Facebook targeting.”

How ServiceX works

trustX has two core objectives: increasing user engagement and decreasing fraud. trustX is a peer-to-peer system in which users and companies are rewarded for vouching for those who ultimately follow through on purchases. Vouching for fraudsters reduces your ability to transact on the platform. Like the ServiceX platform, trustX operates on the blockchain so that it is a true decentralized network of trust.

Credify is designed to comply with the harshest of data regulations. However, the variance in regulations between different countries currently restricts Credify to Singapore. Credify recently received the Singapore Finance Association’s “Fintech Certified” credential, allowing the startup to receive access to government programs and funding. Credify has also joined Singapore’s APIX Platform, a Singaporean collaboration lab to encourage cooperation between innovative startups and major financial institutions.

The Singapore-specific focus (with the potential for Japanese expansion due to TIS’s recent investment) is both a strength and a weakness for Credify. Credify’s localized model will make it easier to serve as the market leader for digital identity solutions in Singapore. Singapore also offers a clear market for digital identity solutions, as the government has unveiled a national digital identity program, which is a rarity among developed nations. However, an overreliance on conforming to Singapore-specific rules could make it difficult for Credify to apply its solutions to different countries.

Regardless of its future expansion strategy, Credify’s big year of fundraising makes one thing clear: The new startup will be a name to watch in the digital identity space for years to come.

ABOUT THE AUTHOR

Quinn Barry is a Tech Innovation Fellow from Stanford University covering innovations in digital privacy across finance and government.