Identity Review | Global Tech Think Tank

Keep up with the digital identity landscape.

Digital onboarding is often a make or break moment for companies. If platforms cannot onboard potential customers seamlessly, they risk losing the lifetime value (LTV) of that user forever.

The problem is particularly acute for financial services companies, which face heavy competition and have high customer LTV. According to MobileID World, 63% of Europeans did not complete a financial application in 2020 due to poor experiences in the onboarding process.

Signicat, a Norway-based digital identity company, and Mambu, a Germany-based SaaS banking platform, have teamed up to tackle this problem and accelerate the customer onboarding process for European banks.

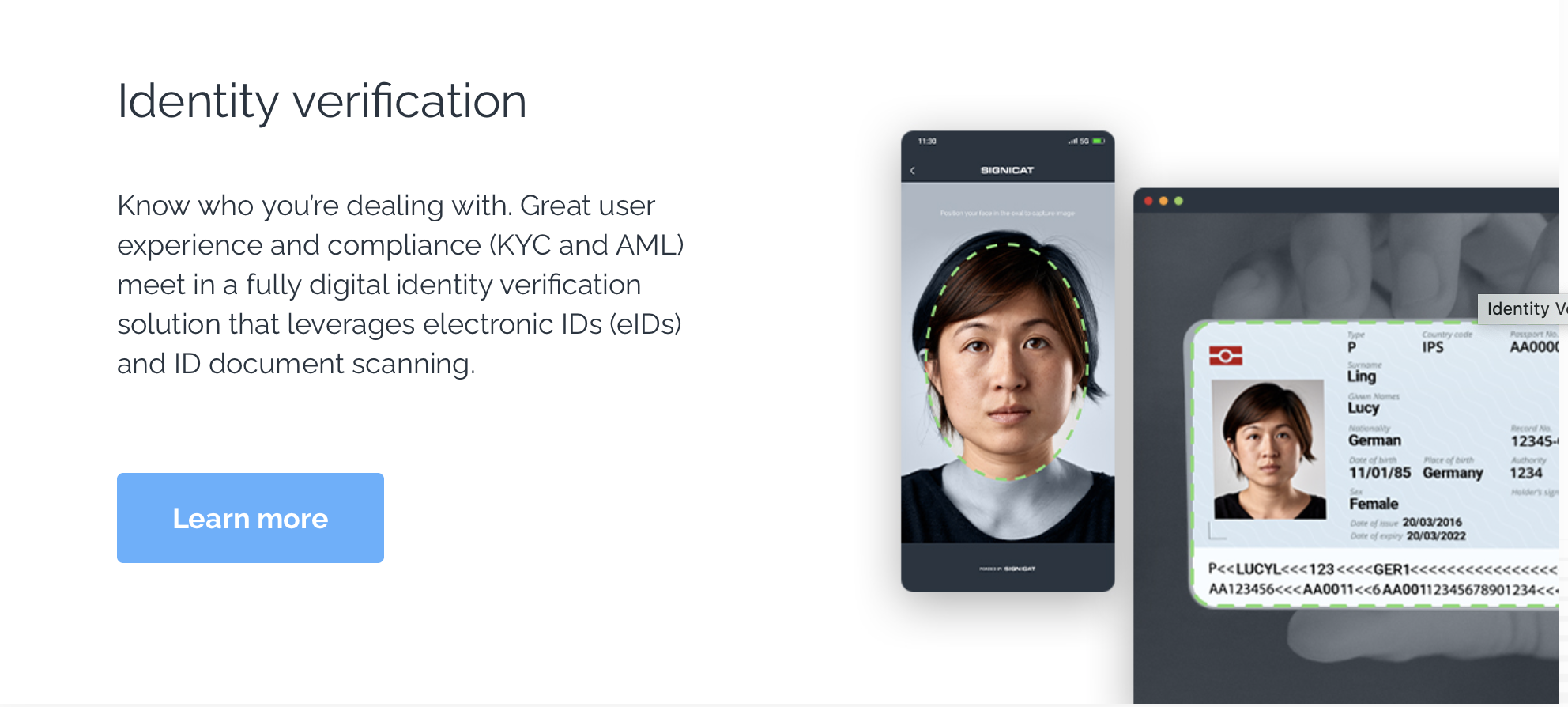

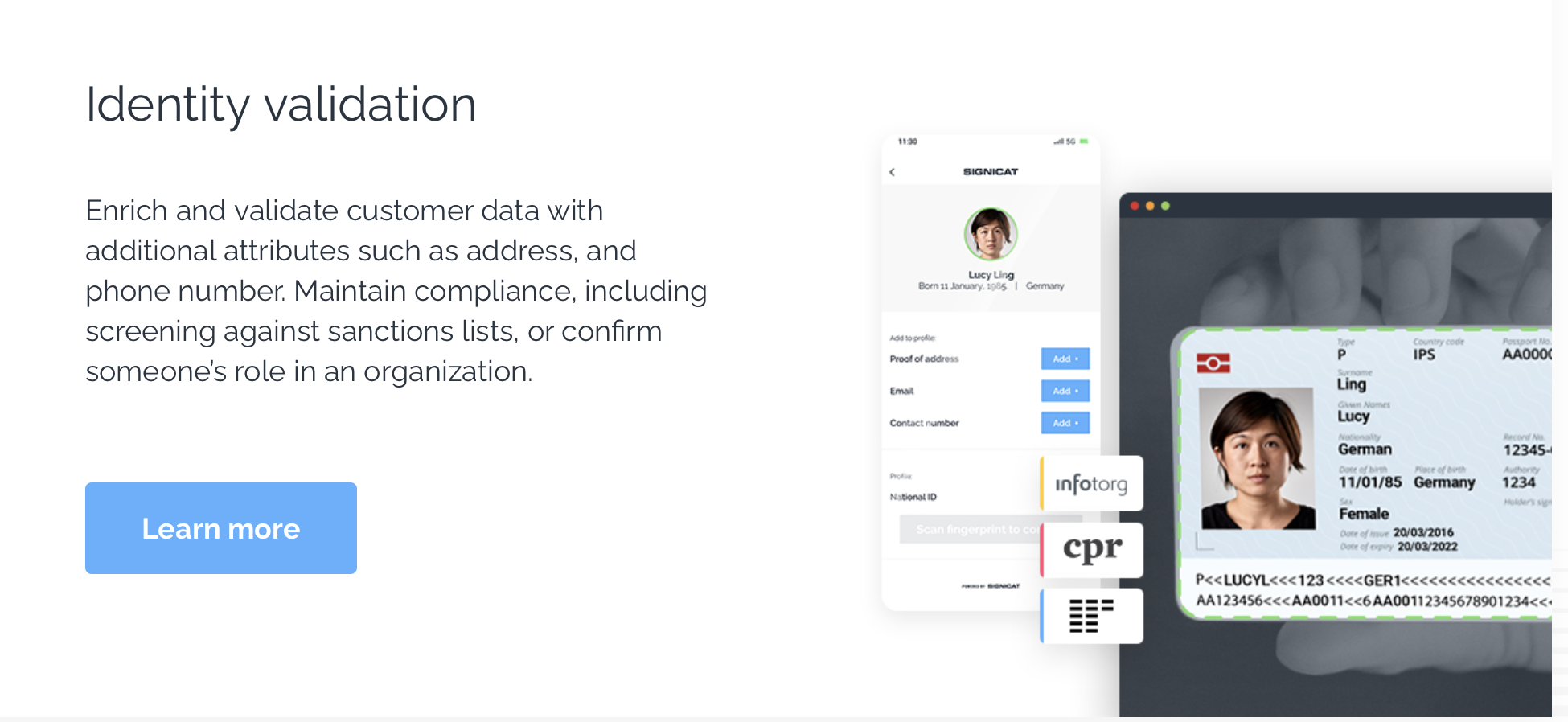

Signicat’s identity verification technology will be integrated with Mambu’s platform through a single API. With this integration, Mambu will be able to create legally binding e-signatures and verify the identity of customers online. Signicat’s platform has both “Identity Verification” features, which comply with KYC and AML regulations and can read virtual or physical IDs, and “Identity Validation” ones, which includes customer-enriching information such as one’s phone number, address or job title.

Crucially, Signicat’s platform works across Europe. Mambu operates in 46 countries and is targeting broader European expansion following a $110 million euro funding round.

Source: Signicat.com

When commenting on the partnership to MobileID World, both Signicat and Mambu representatives noted that COVID-19 has accelerated innovation in the fintech space.

Signicat Chief Executive Officer Asger Hattel stated that “Global lockdowns have turned a desire for digital services into an urgent need. Our research shows that financial service providers are struggling to keep up with consumers’ digital demands—and it is costing them customers.”

Hattel noted that he hopes partnering with Mambu can help Signicat meet the increased demand COVID-19 is driving: “Partnering with Mambu means we can help more providers unlock the benefits of digital identity.”

For Mambu’s part, EMEA Managing Director Eelco-Jan Boonstra said that “Identity fraud continues to be a major threat to businesses across the globe and damages trust” and that concerns of fraud have only increased as a result of the pandemic. Signicat solves a significant portion of the trust challenge for Mambu.

“Signicat’s digital identity platform means that you know who you are dealing with and helps to deliver trusted digital customer experiences.”

The partnership has reportedly already yielded results, with Finland-based lending company Fixura serving as the first joint customer. As Europe’s fintech sector continues to grow, expect Mambu and Signicat’s innovations in digital onboarding to drive more consumers to digital banking in the years to come.

ABOUT THE WRITER

Quinn Barry is a Tech Innovation Fellow from Stanford University covering innovations in digital privacy across finance and government.

Contact Quinn Barry at quinn@identityreview.com.

Do you have information to share with Identity Review? Email us at press@identityreview.com.