Identity Review | Global Tech Think Tank

Keep up with the digital identity landscape.

Constant innovation in the tech industry has shown that digital identity solutions are applicable to hundreds of other industries such as healthcare, finance or any other space where data privacy is needed. Digital identity companies around the world have successfully developed robust solutions, but making these solutions easily implementable for any business is another challenge.

French digital identity services firm Ariadnext announced multiple feature additions to its remote biometric ID verification solutions IDCheck.io and MobileID.io. These upgrades include dynamic document capture and a hybrid verification using a specially trained fraud-detection operator which will ultimately help businesses add additional layers of security to their services and protect users from identity theft attacks in a streamlined way.

One of the most important tasks between a company and its users is building trust—especially in industries like fintech and healthcare. On one hand, customers must trust the services they are using, but on the other, businesses must trust that their users are genuine and not attempting to attack or scam the business.

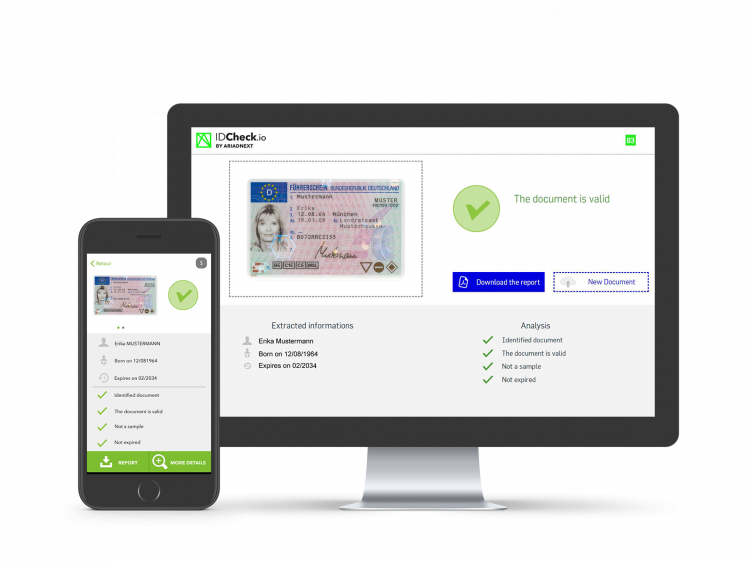

Ariadnext developed IDCheck.io to help bring mutual trust between businesses and users. First, the solution offers document verification services that utilize deep learning technologies to check the authenticity of documents such as bank statements or proof of address. IDCheck.io can also verify identity documents like passports and driver’s licenses from over 180 countries.

On top of verifying the authenticity of the documents themselves, ensuring that the actual owner of the identification is providing the documents is equally as important to prevent fraud. IDCheck.io’s document holder identity verification service leverages Ariadnext’s APIs to offer solution integration with facial recognition and biometric services as well as a living detection service.

Finally, to ensure a streamlined and paperless experience for businesses, IDCheck.io released a new feature for dynamic document capture and scanning on both web and mobile that uses Ariadnext’s customizable SDKs to ensure quality control, optimized user experience, and KYC and AML compliance. The dynamic upgrade to the formerly static feature augments fraud detection capabilities by using AI to compare dynamically chosen document features and points of interest (e.g. Optically Variable Markings such as OVI, OVD, DOVD, or visible relief and perforated elements such as RF holograms and punches) against reference models.

Verifying identification documents with IDCheck.io. Source: Ariadnext

Aside from recognizing the importance of ID verification, Ariadnext also developed MobileID, an enrollment, identification and digital identity management platform. Users can enroll in the platform by scanning their IDs and performing a facial recognition check to validate and securely create their identities. Then, upon authenticating themselves through a mobile application using a two-factor authentication that complies with SCA (Strong Customer Authentication) standards, the platform will allow for companies to manage and maintain their users’ digital identities.

The easy integration of this service, which provides a simple way for users to identify themselves, is what makes MobileID and its modules useful for businesses. For instance, the MobileID app allows users to capture their identity document which is verified through the same API that IDCheck.io’s document holder identity verification service uses, leveraging facial recognition by having the user take a selfie to be compared to the scanned ID document. As an extra layer of verification, the app also performs an identity check via a video detection of the living.

MobileID.io also provides a system for creating, maintaining and managing users’ digital identities, while allowing for the association and use of an authentication method linked to digital identities. MobileID.io then enables the tracking of their activities and the management of the processes associated with their life cycle, giving businesses the ability to validate or invalidate accounts, change identities manually, manage authentication means or get views on connections. The platform also allows user authentication, which is interfaced with standard OIDC or SAML protocols.

Finally, MobileID.io offers Authenticator, a software suite that allows users to authenticate themselves through a mobile application. It includes an SDK that enables the activation and implementation of authentication and signature functions, as well as a server offering the implementation of cryptographic mechanisms for the generation and verification of keys and signatures.

Ariadnext has ensured that all of its functionalities are compliant with France’s new ANSSI criteria published earlier this month that is projected to be enacted in March 2021, and that they also follow Ariadnext’s recent FIDO certification for its face biometric solution.

These new developments mark an important step forward in making digital identity solutions easily accessible and implementable for businesses in any industry.

ABOUT THE WRITER

Serena He is a Tech Innovation Fellow from the University of Southern California who is interested in AI and the intersection of design and technology. She enjoys covering news across the digital identity and tech space.

Contact Serena He at serena@identityreview.com.

Do you have information to share with Identity Review? Email us at press@identityreview.com.