Identity Review | Global Tech Think Tank

Keep up with the digital identity landscape.

Among some of the biggest verticals that have transformed in the open innovation age, open banking goes beyond the essential services of holding money in physical accounts and distributing loans—it has upended the traditional banking sphere.

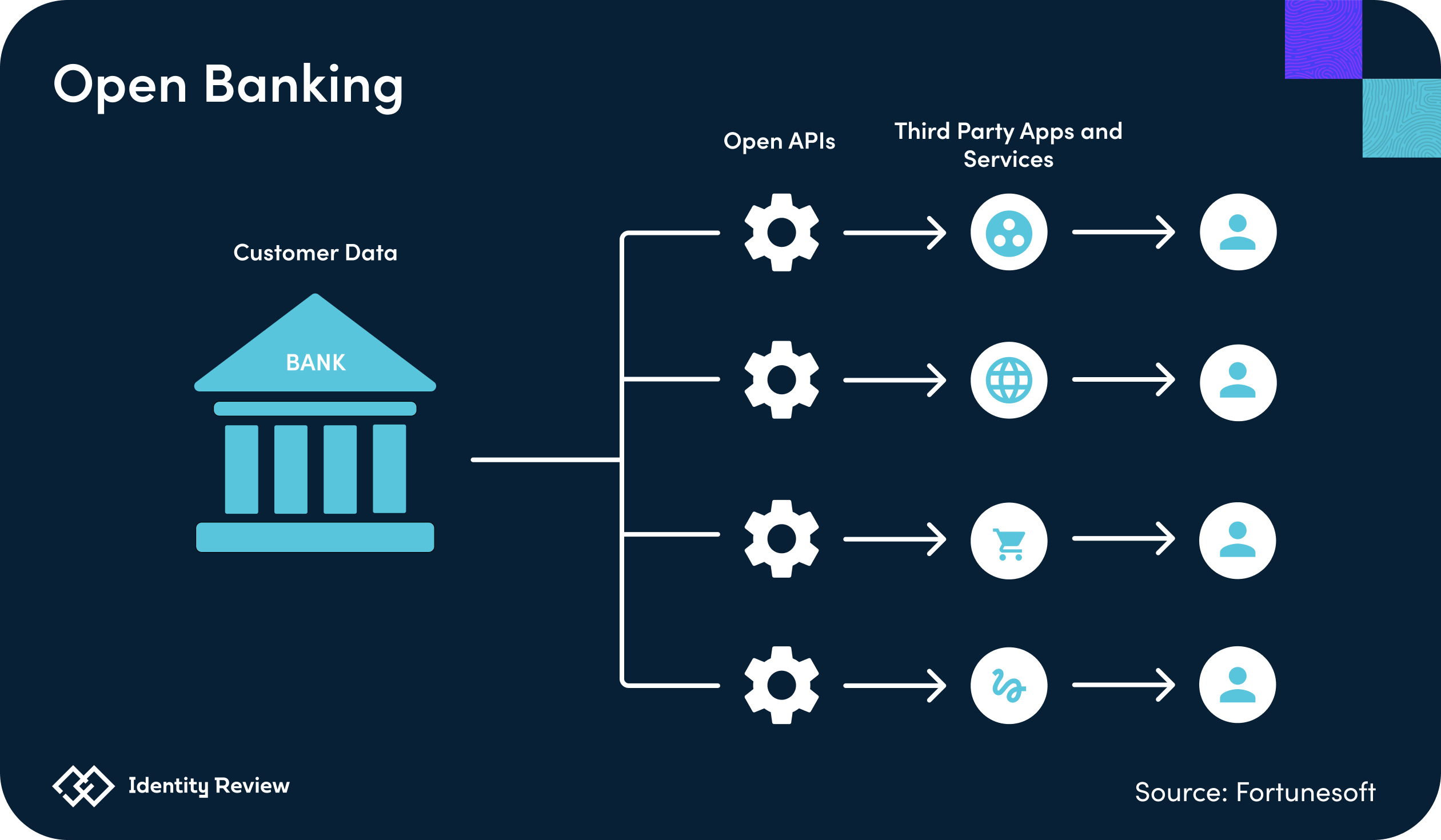

Open banking is a method that gives outside financial service providers admittance into customers’ financial data with customers’ consent. This information is also known as “open bank data.” Completed online and kept secure using application programming interfaces (APIs), which allow companies to access another’s services without having to adopt their entire ecosystem, the goal of open banking is for intermediary companies to increase the efficiency and accuracy of banking for customers and providers.

These third-party APIs allow information to be shared digitally and in real-time, innovating any bank process that uses customers’ financial data, such as loan requests and trades. Customers can see opportunities and risks fast and accurately through these platforms, and lenders and service providers can assess information and communicate with fewer, less complicated steps.

More than anything, open banking APIs create a space for accounts to network so that banking data can be combined and evaluated both at a larger scale and with a shorter duration. The field has evolved the following processes:

This concept is also slowly reaching its way into the finance world. Before APIs, traders had to evaluate opportunities and then separately allocate trades with a broker. These APIs now act as the connection between the trade screening process and brokerage accounts, combining the steps within one application. APIs also gather the data to allow traders to view opportunities in real-time and lead to more accurate trading decisions.

Open access to financial information appears high-risk, yet customers are always asked to grant permission to share their data before their data is thrown into the open banking schema. APIs likewise have security capabilities built into their programming. They often do not need specific credentials to share data among players, which keeps this information private and boosts fraud control.

While APIs are secure, they are not entirely unhackable. That said, API hackers are not considered top cybersecurity threats.

Simply put, open banking allows for more channels of revenue for firms. APIs create more opportunities for value and growth by opening doors into a broader market, helps with customer relations and lends firms more transparency with customers to cater to their needs.

Open banking, in short, allows firms to build stronger relationships with their customers. Because APIs personalize how a customer’s account looks, a decision about investments or funds generated are accurate and idealized—a high priority for customers and providers.

Do you have information to share with Identity Review? Email us at press@identityreview.com.